Cryptocurrencies

Cryptos just keep on going 24/7/365 – feels like there is no time to unwind or take a break so before the technical charts become invalid let’s dive into them. The total MarketCap sits @ 296 billion at the time of writing up from the 250 billion mark last week thanks mostly to the strongest performing Bitcoin. Ripple remained the weakest performing.

Bitcoin (BTCUSD — MT Neutral, ST Bullish) Ehtereum (ETHUSD — MT Neutral, ST Neutral)

Ehtereum (ETHUSD — MT Neutral, ST Neutral)

Ripple (XRPUSD — MT Bearish, ST Bearish)

Bitcoin Cash (BCHUSD — MT Bearish, ST Neutral)

EOS (EOSUSD — MT Bearish, ST Neutral)

Forex Markets

Greenback’s resilience & persistent strength is keeping the Majors under pressure. Venezuela has decided the re-denomination of its currency by pegging it to National cryptocurrency of Petro ever since the 1,000,000% hyperinflation has rendered it useless. Bank of Japan’s announcement of aggressive bond buy backs pushed the Yen higher with the biggest move coming in USDJPY in Majors. Busy week ahead for the Economic calendar with rate decisions from FOMC, BoJ & BoE, NFP data from U.S, Canada’s GDP, Employment numbers from Germany & New Zealand among others.

EURO (EURUSD — MT Bearish, ST Bearish)

POUND (GBPUSD — MT Bearish, ST Bearish)

POUND (GBPUSD — MT Bearish, ST Bearish)

YEN (USDJPY — MT Neutral, ST Bearish)

LOONIE (USDCAD — MT Neutral, ST Bearish)

AUSSIE (AUDUSD — MT Bearish, ST Neutral)

Equity Markets

Good news for U.S markets with things moving towards resolution over the tariffs issue with EU & a blockbuster number of over 4% GDP growth sent the markets for a fourth successive week of gains but the Tech index dragged lower with the earnings from Facebook & Twitter precipitating the move. Let’s review the numbers from the World markets this week.

U.S. — DJIA (+1.57%), S&P 500 (+0.61%), NASDAQ (-1.06%),

Europe — FTSE100 (+0.29%), DAX (+2.38%), CAC 40 (+2.10%)

Asia — Nikkei 225 (+0.07%), BSE Sensex (+2.30%), Shanghai 50(+1.26%)

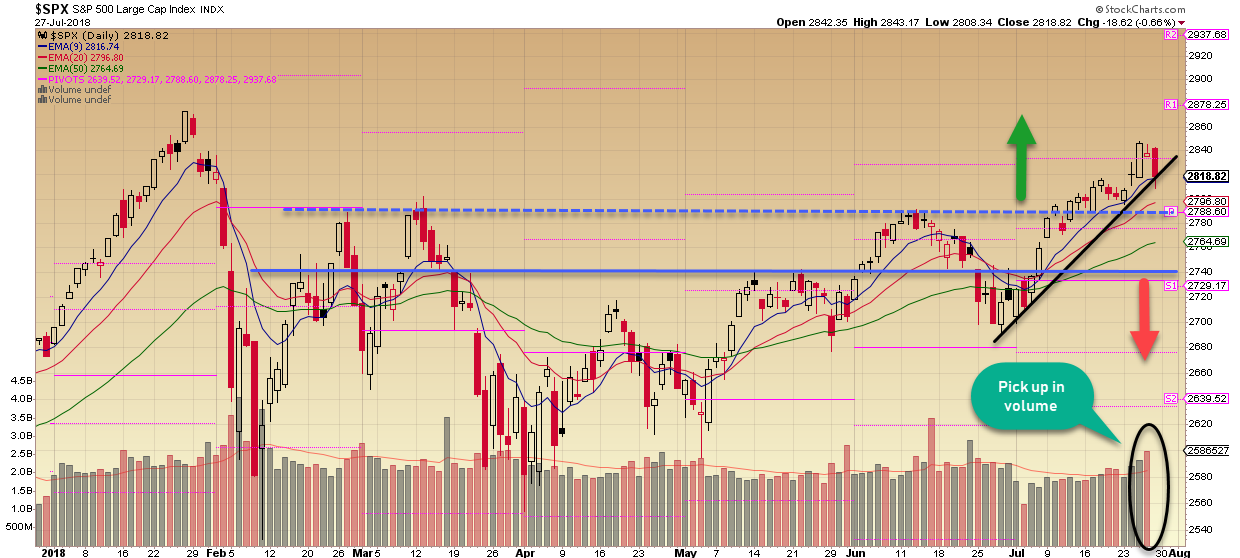

S&P 500 managed to close higher for the week despite the tech earnings inspired sell off on Friday. Still holding on to the confluence of 9EMA & bullish trend line. Looks constructive as long as the confluence point around 2815 level holds below there would be an extension of the consolidation. In other news, Pinduoduo (PDD) has priced its U.S. IPO at $19 per American depository share, raising $1.63B in the second-largest U.S. float by a Chinese firm in 2018.

Trade idea of the week to sign off on things – ULTA

Tech rollover pinched the investors hard with the falls in Facebook & Twitter.

Related Articles: Trading USD Majors in Forex, Trading Psychology & Lessons learnt, Jack of all trades… Master of one!, One size fits all trading strategy?

Stay in touch: Twitter | StockTwits | LinkedIn | Telegram| Tradealike