October showers bring May flowers. Does the same hold true for these stocks?

These stocks are primed to do well in October and beyond based on their recent return. With the market seeing a little pullback over the past month, these five stocks have more than doubled from their March low and continue to go higher. The stocks are in different sectors of the market and they may be stocks you want to keep your eye on and possibly add to your portfolio.

In addition to buying things every month and paying your bills, investing needs to be part of monthly habits. You don’t have to be wealthy to invest. These days anyone can invest with just a few dollars a month. Various investment platforms offer zero commissions such as Webull, Charles Schwab, Etrade, and others.

After a turbulent year in the stock market, you may have heard of these stocks that are performing very well. The five stocks are:

- Beyond Meat (BYND)

- Crowd Strike (CRWD)

- Roku (ROKU)

- Square (SQ)

- TopBuild (BLD)

The price for the stocks was recorded on October 8, 2020, at the close of the market.

Beyond Meat (BYND)

This company gained a lot of attention before the stock was released and the stock price took off initially. After the price dropped, the stock is close to the high it reached a year ago. Beyond Meat sells plant-based meat products that are found in many restaurants, grocery, and convenience stores. The company is expected to continue growing as they have plans to provide meatballs sometime this month, expand into China, and add an e-commerce site to the market.

Analysis. Like other companies, Beyond Meat took a dip in Q2 as the coronavirus started spreading in the United States. Earnings from the company are expected to be in the black for Q3 as retail and direct-to-consumer sales increased (190%). In the near future, the stock is expected to increase as more stores offer Beyond Meat and sales continue.

Crowd Strike (CRWD)

This United States company provides cloud-based services worldwide as they provide services in the United States, Australia, Germany, India, Romania, and the United Kingdom. As more people are working from home, cybersecurity is needed more than ever. CrowdStrike conducted a recent acquisition of Preempt Security that will strengthen its role in personal identity security.

Analysis. The company is growing as it upsells current clients with new products. Clients that used four or more modules increased 57% (up 17% from three years ago) and those with five or more clients increased to 39%. Revenue increased by $104 million as subscriptions increased by 89%. The retention rate is very impressive at 98%. The company is becoming the recommended choice as 49 out of 100 Fortune 100 companies are customers. Analysts expect 71% growth in Q3.

Roku (ROKU)

Roku serves as the gateway for many streaming services and is the main operating system in smart televisions. Streaming has been on the rise in 2020 as more people are home because of the virus and movie theaters were closed. Many streaming services want to work with Roku and this is a major benefit to this company.

Analysis. The company saw great progress in Q2 as 3.2 million accounts were added and finished the quarter with 43 million active accounts (up 41%). Sales of the Roku unit increased (up 28%). Strong growth hs continued for Roku in Q3 according to management. The stock price is closing in on their all-time high for the stock price.

Square (SQ)

If you haven’t heard of Square, this company provides a point of sale solution and payment system. Included with the Square system are various products such as a portable payment device and payment solutions. Square added Cash App, a peer-to-peer lending system. Customers can send and receive money to anyone. This platform allows you to send or receive paychecks and tax refunds. An additional feature allows you to invest your money in stocks or bitcoin.

Analysis. From a year ago, Square’s revenue is up 361% for a total of $1.2 billion. Gross profit is up 167%. Much of the increase is driven by bitcoin which has it’s volatile price swings. Payments should continue to grow and remain steady as business continues to grow. Revenues should grow 30% plus with cash flow increasing for the company.

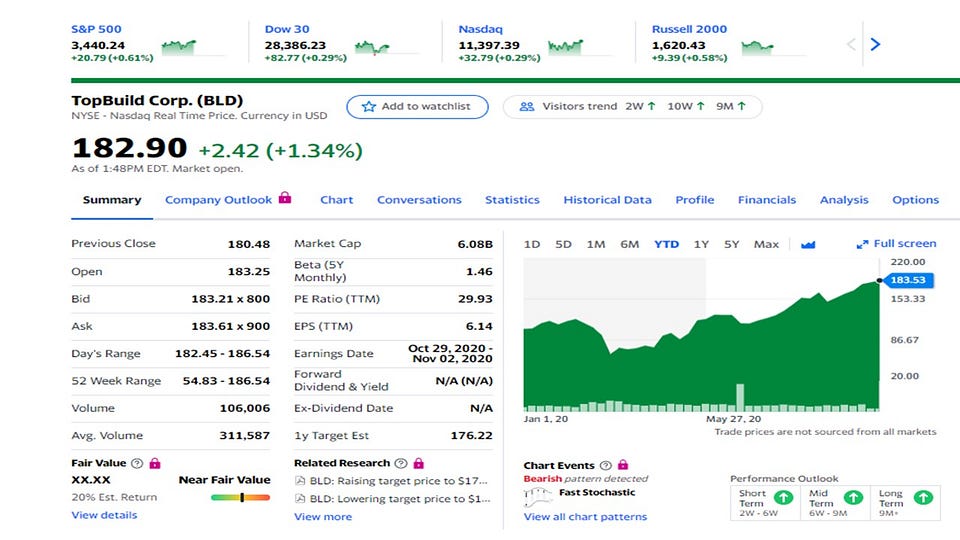

TopBuild (BLD)

This United States company installs and distributes insulation and building products to the construction industry. The real estate market is remaining strong with home sales reaching 25% in July along with strong confidence in the homebuilder market. The company offers insulation products and services. Focus is on single-family and multi-family home builders, single-family customer builders, and contractors.

Analysis. Analysts expect growth to continue with better than expected results. By Q3, earnings are expected to continue 20% this year. The stock rebounded to new highs in May and has continued to trending upward. The stock is a key player in the housing market.

Disclaimer: The writer does not own any of these stocks but the writer’s son has owned Roku stock since it’s IPO (initial public offering).

How Did I Turn $166 into Six Figures in Less than 10 Years?

My Outline for Reaching Six Figures

medium.com

References:

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any significant financial decisions.

The question I raised a moment ago was about my free 14 day entry to your service. When did I start the subxcription and what is your phone number? Jurgen Goldhagen