A Q&A with Simon Cullen, founder of RiskSave Compliance and tech entrepreneur

The need for greater investment in technology has become more important than ever in financial services. But when it comes to digital platforms and blockchain technology, industry incumbents often struggle to keep up.

Last week, I briefly caught up with RiskSave’s Simon Cullen. With RiskSave having just launched its Blockchain Regulatory Innovation Centre (BRIC), we discussed the importance of FinTech, blockchain regulation and the purpose of innovation centers such as BRIC and Level 39, as well as his own experience in the finance industry, from his time as a bond trader to becoming COO of a leading RegTech company.

How did you get started in FinTech and what is your role now?

I had a very traditional finance career. I was a trader, portfolio manager then a senior compliance executive with regulatory relationships. It became clear to me that automation of processes was going to change finance and regulation markedly, and with a former colleague (and ex-trader) we created an innovative firm to supply software to banks and asset managers.

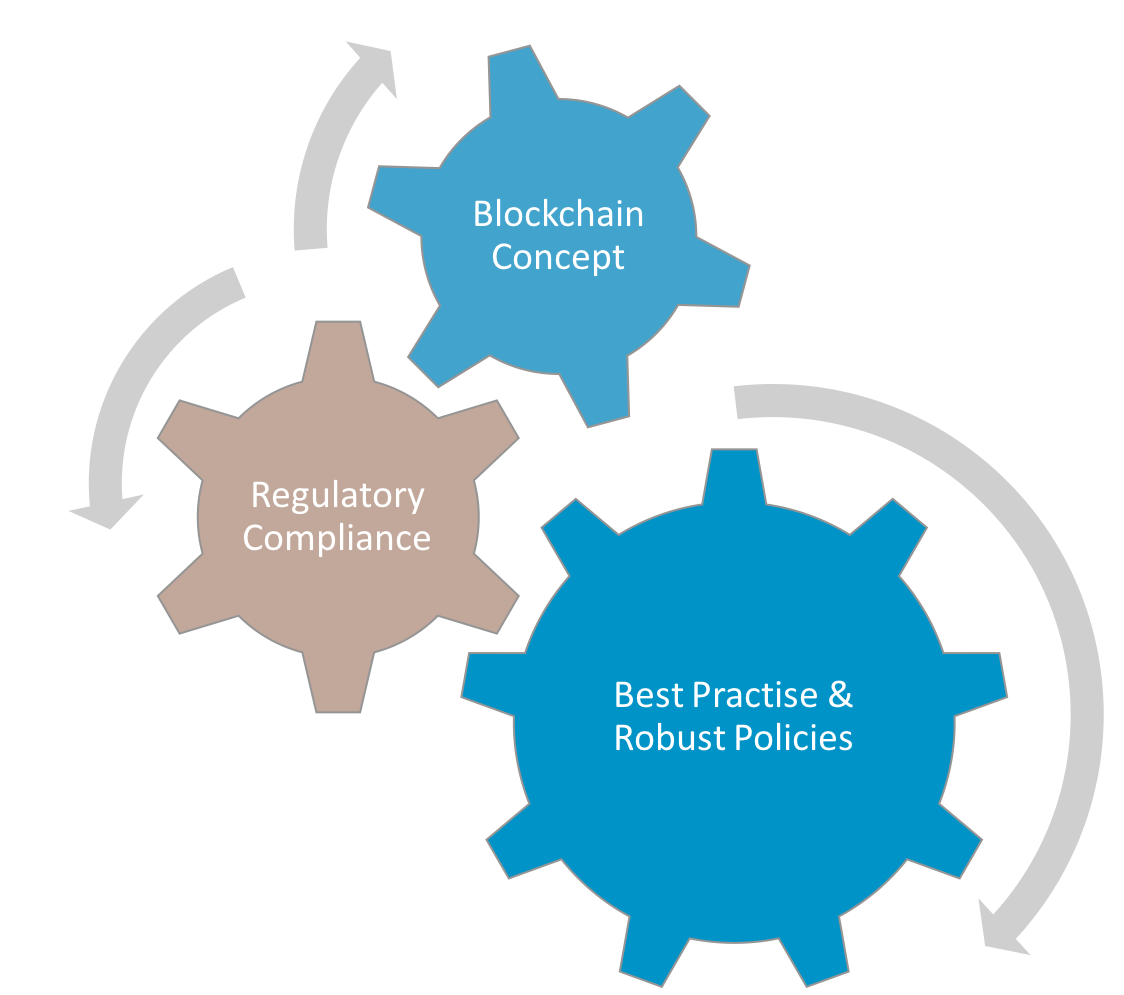

When I founded RiskSave I wanted to apply cutting-edge technology at every stage of the risk-management process. Our systems and expertise relieve fast growing businesses of the strategic and operational burden of regulatory compliance, allowing them to focus on our core strengths. Being part of the Level 39 ecosystem exposed us to blockchain technology early, so our team always appreciated the value of different technologies. We were able to found BRIC to help firms with deep product knowledge of distributed ledger technology (DLT) offer services in regulated sectors quickly and easily.

What is BRIC?

BRIC is the Blockchain Regulatory Innovation Centre. It offers access to our systems and compliance expertise. In addition, our pre-existing regulatory hosting platform is available to blockchain firms seeking access to European markets.

BRIC offers a collaborative partnership with leading businesses operating within DLT, where we collaborate to develop future-proofed policies and processes so that they are ready for any changes the regulators introduce. Our relationships in this space include blockchain firms big and small with employees ranging from one to over a hundred.

Firms selected for a collaborative project within BRIC can be sure that they preparing for the long-term and (hopefully) anticipating regulatory change.

How do you think that the RiskSave Blockchain hub differs from other accelerators and compliance services?

Firstly, in terms of focus; and secondly, in terms of integration. Finance has always been an avid consumer of technology. The large banks have always spent money on trying to force an edge when trading in the Capital Markets, but what we’re seeing now is that regulators are so much more powerful and knowledgeable than they were a decade ago. So, there is a need for the front office to understand their compliance obligations. BRIC has been built from Day 1 with the Front Office and commercial needs in mind.

The aim is not just to understand the proposition and draw up compliant procedures, but for compliance to be built into the process. We look at regulatory understanding as a competitive edge, and with many services looking to add Blockchain based systems to their proposition, there’s a clear value add to being thought leaders in both DLT and Compliance.

Apart from Compliance, what else do you think is important for DLT propositions?

Firstly – I would say understanding the market, and more importantly if one exists. Plenty of coders, develops and FinTechers get super-excited about what they’ve built, but without considering whether it is valuable and who it might be valuable to. If the market isn’t there you might be too soon, you don’t want to be selling Google in the ’80s.

Secondly – I’d say execution. Often coders, developers and other technologists neglect the other issues in a corporation as they try and build the best product. But its important to remember that even if you have a brilliant technology and then create a brilliant project you are still short of success. You need to identify clients, overcome internal opposition to sell it, whilst demonstrating superiority to existing products. Then you need to support the idea and create recurring revenues. This can take a decade or more after the MVP. Sadly brilliant idea and brilliant engineers can someone times lead to nothing if i) the marketing isn’t there, and ii) the market knowledge isn’t there.

What is your favourite part of FinTech?

I’d have to say RegTech. I might be biased, but we entered the space with both RiskSave and BRIC because we thought it mattered. Right now compliance is more important than ever. A compliance program is vital to provide stability, an automated process can be even better. With BRIC our policies and processes were designed with blockchain in mind and we look forward to supporting the development of this technology and helping establish an ecosystem.

What FinTech products are you currently using?

I’m still amazed at how easy to use my Revolut card is. The digital journey is pretty much perfect and it actually saves me money. I’m still looking for a compelling Digital Pension proposition but I’m sure there’s one out there.

Thank you for another excellent article. Where else could anyone get that kind of info in such a perfect way of writing? I’ve a presentation next week, and I am on the look for such info.