It is heartening to see how slowly but surely, the global focus of the private sector is shifting towards the collective societal well-being & preserving of the environment. These issues have taken center stage as we move towards achieving the goals of sustainable economic development, where we not only need to take into account the importance of regular & manufactured capital but the preservation and promotion the human & natural capital. World Economic Forum report on impact investing in collaboration with the UK government is very useful & enlightening – it summarizes how the global governments are taking tangible steps to implement impact-investing agendas.

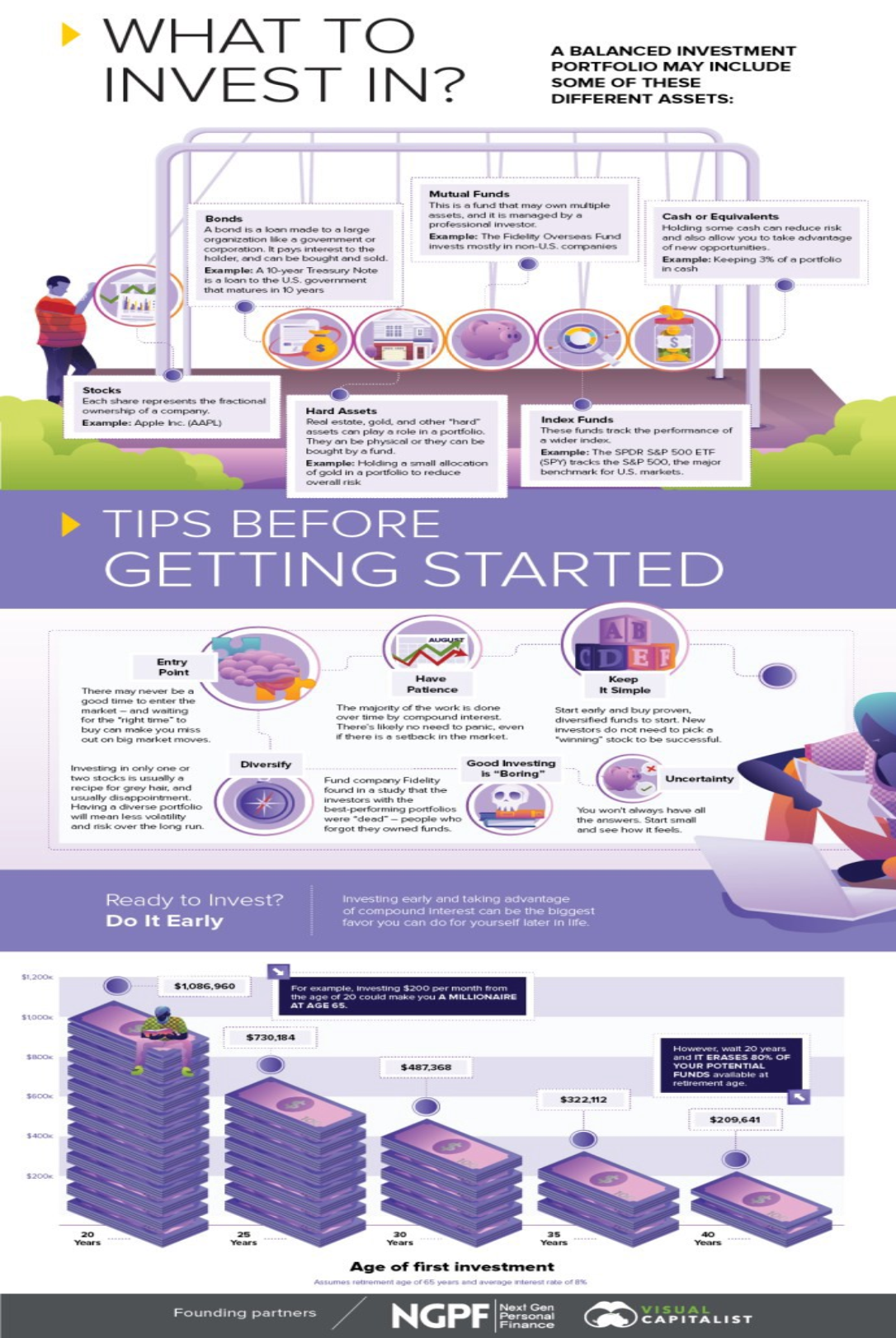

Let’s start off with defining simple saving by investing, whether it is for a rainy day, retirement or purchase of a big-ticket item like a house. Investing takes a little more planning & acumen. Depending on your knowledge of Investing, you have a choice of having a self-directed account or a managed account. The former is only suggested if you have advanced knowledge of the subject & more importantly have the time to manage your account on a consistent basis. However, if you are like the majority, where you are either not from financial background or simply don’t have the time then you should opt for a good financial adviser who can understand your risk profile, objectives & goals to build a suitable portfolio matching these metrics. Following is a useful infographic with tips on investment.

Moving on, I would like to introduce you to the concept of Impact Investing & Sustainable investing which have started to gain traction recently with the enlightened view of businesses of their role in the society. Impact Investing which has traditionally remained localized to development institutions & specialist funds (green bonds etc.) is beginning to go mainstream as investors are increasingly looking towards generating societal benefits apart from achieving personal goals. The impact investing market increased 5 times between 2013–2017 to $228 billion globally. Sustainable investing, on the other hand, takes on a little broader approach taking into account environmental, social and governance (ESG) factors where financial return is generated while measuring the impact social & environmental impact. These initiatives have taken a new dimension with the launch of an ethical stock exchange in Scotland recently. We are moving from an individual focus towards impact investing to financial markets taking the moral high ground as well.

The initiative has been taken by Edinburgh (UK)-based investors by launching a company called Bourse Scot, which has the backing of the Scottish government. The last time Scotland had an exchange for itself was back in 1973 before it merged with the London Stock Exchange. However, this time around it is not just a separate stock exchange but one with a mission – companies who wish do business on the exchange will have their ethical credentials thoroughly evaluated. Only Companies with high moral standards will be allowed to conduct business. Not only this, but the companies will also have the onus to prove how they are creating a positive impact in the communities where they are operating.

Bourse Scot CEO and founder Tomas Carruthers speaking on the occasion put their mission in the following words:

“The project is strongly informed by my vision of a capital market that serves society, that can be trusted to serve all stakeholders – a market which social entrepreneurs, charities and local authorities can use and find investors who are aligned with their mission.”

On the business side of things, Bourse Scot will be partnering with European Stock Exchange operator Euronext, which runs stock exchanges in Amsterdam, Brussels, Dublin and Paris. It will also provide its Optiq platform to run the new Scottish exchange with two European clearing houses being roped in to process the transactions. Bourse Scot is neither the first or the only Social Stock exchange (SSE) in the World as others have been established in various parts of the globe to provide exposure to people to Socially Responsible Investing (SRI). Let’s take a quick snapshot at these:

- Canada (Social Venture Connexion) – This Canadian SSE opened in Sep. 2013 & backed by the respective provincial government is perhaps the only one which comes close to being a full-fledged social exchange albeit for institutional investors only. It acts as a connecting point between social businesses & prospective impact investors.

- UK (Social Stock Exchange) – The British SSE which opened in Jun. 2013 does not provide share trading facility directly. It provides a database of companies who have passed a rigorous “social impact test” while at the same time acting as a research resource for would-be social investors.

- Singapore (Impact Exchange) – Also opened in Jun. 2013, it is the only Public exchange out there. The functionality is pretty similar to the UK SSE, however, it goes beyond by listing social businesses which also include non-profits in the sector who can issue debt instruments like bonds.

- South Africa (SASIX) – The second global SSE ever was opened in Jun. 2006 with a mandate to provide financing to social businesses. SASIX works like a regular stock exchange where impact investors can buy shares in social businesses based on its geographic location & mission.

In addition to these Brazil in South America & Kenya in Africa have become the focal points of impact investing. A lot still needs to be done to get the momentum going. The accreditation of SSEs remains the biggest challenge, which can be addressed through education & awareness, devising of proper Policy & regulations, creating more social businesses and investment in Research & Development. With the focus shifting towards ethical, sustainable & socially responsible investing, initiatives like these will eventually gain mainstream adoption. What better way to save, invest & profit through one which also provides for the collective good & preserves our environment.

Email?| Twitter? | LinkedIn?| StockTwits? | Telegram?