As the bull market strengthens with each passing day in the Cyptocurrencies, we can be cautiously optimistic that the Crypto winter is behind us. This morning Cryptos have really come alive as Bitcoin trades around the $6900 figure followed by similar gains in Alt. coins – BTC is trading well above the MT support (originally resistance) line of $5850. The sustainability above this level would define the continuation of over a month old recovery. Anyways that’s all we are going to talk about the price action today. I am going to be discussing a few recent developments in the Premiere Alt. coin & dApps platform Ethereum (ETH). While ETH has been gaining on the back of broad-based gains in the general Crypto market, there have been other factors in play recently too which have given this recovery some substance. Ethereum has provided a baseline platform for the production of new digital tokens with its native & vastly popular ERC-20 standard, coupled with dApps & smart contract functionality. Let’s move on see why Ethereum is a on a strong footing as we go forward.

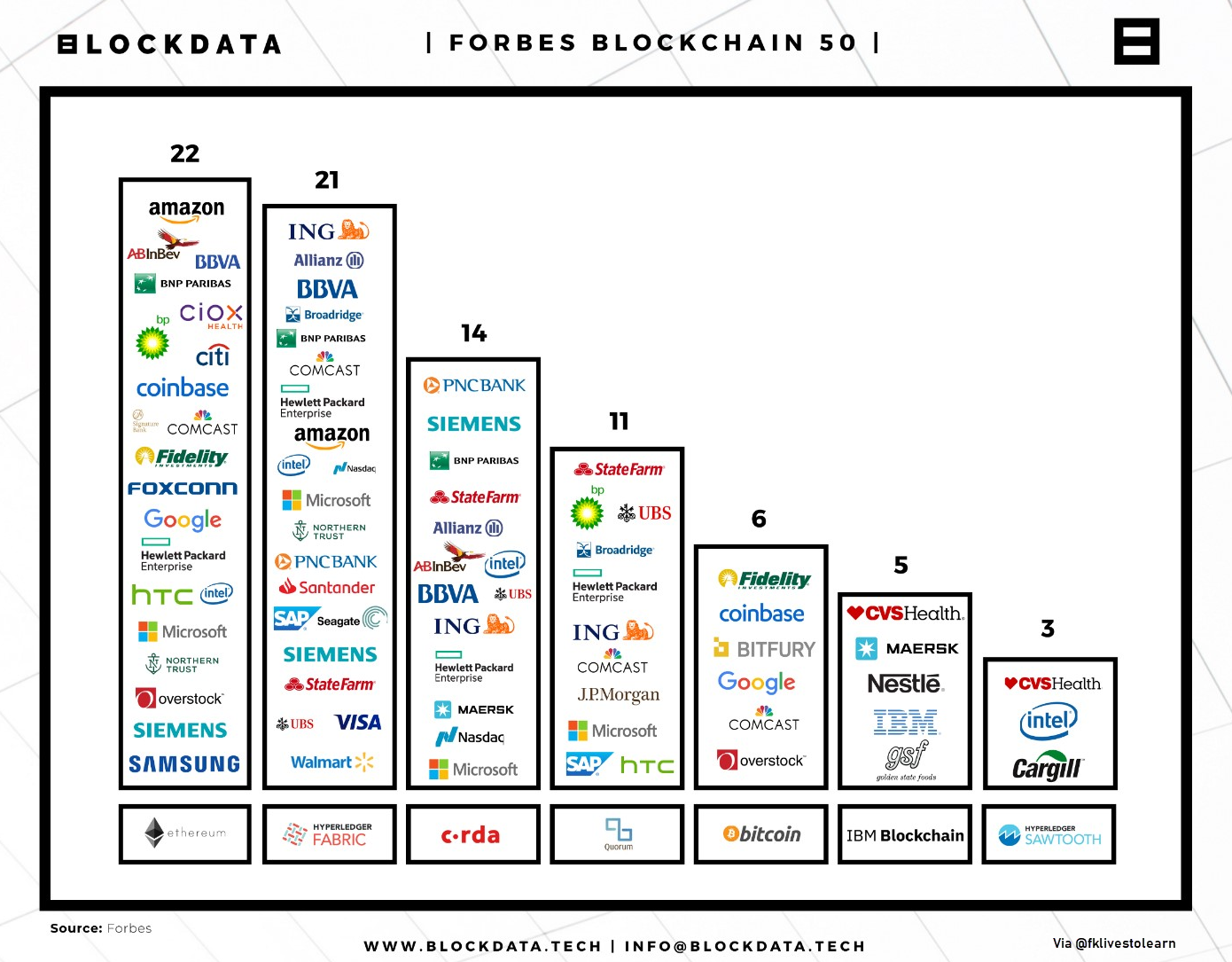

Enterprise blockchain (Adoption)

As far as enterprise level blockchain platforms are concerned, Ethereum is leading the pack (infographic above), followed closely by the IBM & Linux Foundation’s Hyperledger Fabric. Some of the big names in the tech industry have adopted the premiere smart contract platform to be the foundation for their enterprise level blockchain solutions. The data from the Blockchain 50 list shows the increasing interest of the mainstream tech companies in the potential of the DLT technology with a lot of them opting for multiple technologies. The pioneer in any field reaps the biggest rewards & Ethereum’s top spot is no surprise here, but the development team of the platform is not sitting on its laurels as the recent upgrade points towards more scalable, efficient & secure solutions in future as we discuss next.

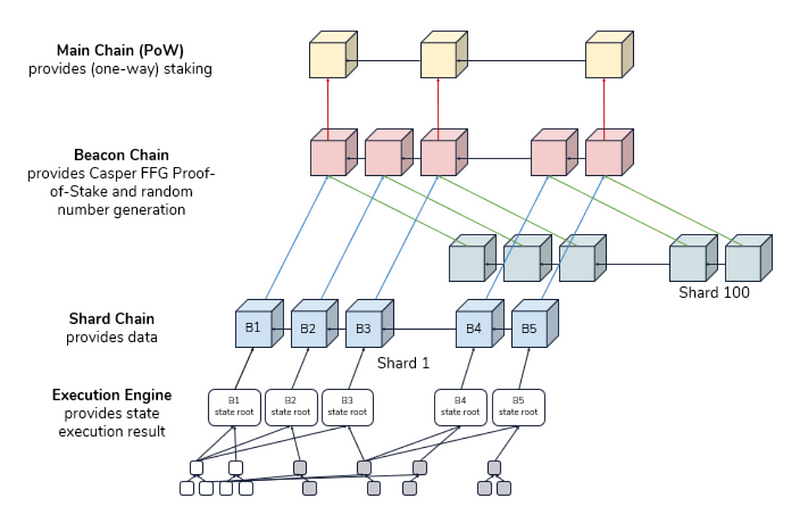

Ethereum 2.0 (Upgrade)

The much-awaited system-wide upgrade Constantinople & St. Petersburg finally went live during Ethereum’s 7,280,000 mined block on Feb. 28th. Although the upgrades were plagued by multiple delays, the fundamental change in the underlying consensus protocol from PoW to PoS has been set in motion with his upgrade. The whole transition is going to be achieved in phases & latest news suggests the finalizing of the PoS code in June 2019. Also in the news was the release of the Ethereum’s beacon chain as announced by Preston Van Loon, co-founder of Prysmatic Labs working on the solution offering better scalability, security & decentralization. As suggested in the post, Ethereum 2.0 wouldn’t be a hard fork – it would rather allow the transfer of value via smart contracts. Sharding is going to be employed in the upgrade – the concept basically allows independent chains to manage & execute smart contract while staying pegged to the main chain.

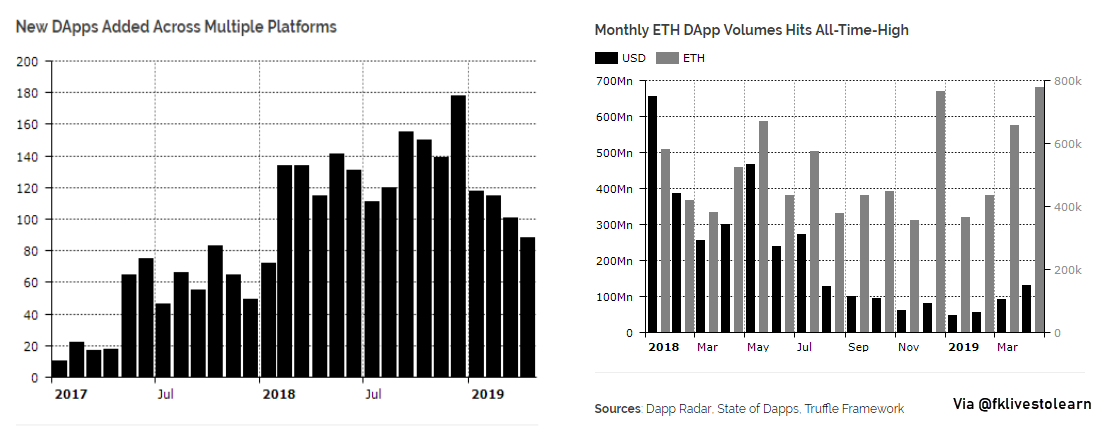

dApps Expansion (Popularity)

Platforms like Tron & EOS have been gaining on Ethereum lately in the dApp market space as suggested by the Dapp.com Q1 2019 Dapp Market Report. Tron has actually seen the biggest user growth among dApp platforms. According to a more recent diar report, however, monthly ETH dApp Volumes have hit an all-time high even with the waning deployment on dApps across different platforms (figure below). The diar report outlines that 776K was transacted on dApps marking a 4-month, most prolonged period of growth ever. $132 million transacted on the dApps also marks a 4-month winning spree, a 8 month high & a whopping 186% increase over level seen in January this year. The report data clearly suggests that Ethereum is still dominating the dApp space.

ETH Futures (Investment)

And finally to the trading world, where the wait for Bitcoin ETF & Bakkt physical BTC futures has become agonizingly long. On the other hand, Regulators in the U.S are taking a liking to the idea of launching Ether futures. According to a Coin Desk, The U.S. Commodity Futures Trading Commission (CFTC) which oversees the Derivatives market is willing to approve ETH futures if an application is made for such. CFTC has already allowed for BTC futures to be trades by CME & CBOE. This of course means that an application for cash-settled ETH futures would get a favorable response from CFTC. Any such move would open ETH to the broader market including institutional investment while providing confidence to regulators like SEC (Securities & Exchange Commission) to approve an ETF (Exchange traded fund) which can bring massive liquidity for the underlying digital asset. The immediate reaction was a jump of 9% in the price of Ethereum. In a related & a bigger move, Fidelity Investments, one of the biggest asset managers in the World is planning to include buying & selling of Cryptocurrency investments for its institutional clients.

The adoption boom for smart contract platform so far in 2019, its upgrade, coupled with a strong recovery from general markets point towards better days ahead for Cryptocurrencies led by pioneers like Ethereum.

Email ?| Twitter ? | LinkedIn ?| StockTwits ? | Telegram ?