FIFA World Cup . A look at inflation numbers . Thanksgiving holidays . FTX Bankruptcy & US Sports Stars

Update: after Asian Market Close 21.11.22 Monday

- China reported its first Covid-related death in almost six months, leading to negative performance of HSI (-1.87%) & HSCEI (-2.02%), as investors fear a ramp-up of Covid-related restrictions in China again.

- This is definitely one of the risk factors that dampen A BULLISH consensus for Chinese shares is emerging on Wall Street

- Major Asian indices are all negative for the day except for Nikkei 225 (+0.16%) and Thai SET (+0.09%)

MAJOR MARKET MOVEMENT (Week of 14 Nov 22, W46)

- MSCI China Index extended its gain by 4.2% this week, up 24% from recent lows.

- A shortened trading week in US market due to Thanksgiving holidays.

THE NOTABLE

FIFA World Cup Qatar 2022 and market behavior (20 November to 18 December)

- Research from Dr. Philip Drummond of Monash University has found that home equity markets suffer reduced liquidity during games.

- Investors should anticipate possible pullback in markets as short-term traders lock in gains ahead of the Nov US CPI release and the December FOMC meeting near mid-Dec.

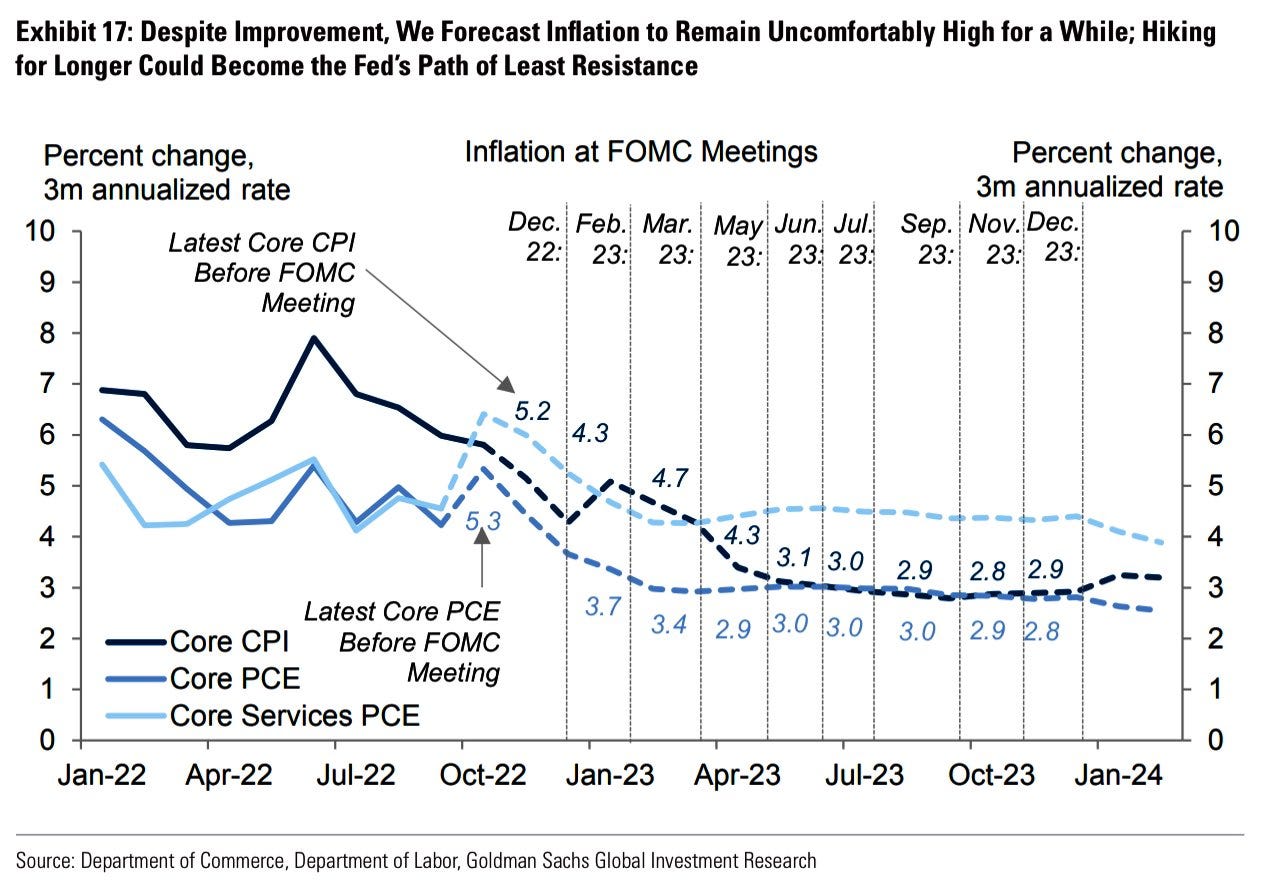

US Inflation to Remain Uncomfortably High for a While

- US inflation seems to have peaked at 9.1% in Jun 22, gradual down trending to 7.7% in Oct 22.

- Despite improvement, inflation is forecasted to remain uncomfortably high for a while.

- Investors should not be overly optimistic with FED pivoting with rate cut. Slowing down of rate increase is on the cards should the decreasing trend of CPI continues.

FTX Bankruptcy & US sports stars

- Naomi Osaka and Tom Brady among US sports stars named in FTX deceptive practices lawsuit.

- The celebrities helped promote the cryptocurrency exchange, which declared bankruptcy in the US last week.

- A lesson for investors, don’t let your love for the sports stars equate with how much they know about financial instruments.

- I’ve noticed an increase in celebrity endorsement of financial products in my home country and it is worrying, at least for me.

RETURN DRIVERS

The VP Bank Supply Chain Index 3 Nov: Things are looking brighter as the index continues on its recovery path, meaning that supply chains are again functioning significantly better. The improvements reflect a better inventory situation in the EU.

A BULLISH consensus for Chinese shares is emerging on Wall Street

- After the conclusion of the Nation People’s Congress, President Xi Jinping has turned his attention to fixing the world’s second-largest economy, with a mini Covid pivot and a detailed 16-point support plan.

- PBOC/ CBIRC supportive policies can be summarized as follows: 1) lending support for developers; 2) strong focus on project completion; 3) easing of mortgage repayment pressures; 4) support credit flow for M&A, rental and retirement homes; and 5) market-based approach to handle credit stresses.

- With such strong fiscal and monetary support from the Chinese government, it is definitely time to look for gems in the Chinese stock market.

- In fact, some of the China Reopening beneficiaries have begun to outperform since July.

Goldman Sachs is overweighting the following sectors.