In this article, my goal is to provide readers a framework to analyze real estate investment trusts in today’s day and age. Before getting started, I would like to remind the readers that the views in this article are my own and are not to be used as investment advice.

What are REITs?

An equity real estate investment Trust (hereafter “REIT”) is a public company that owns, manages, or finances income-producing properties. REITs might be present in the residential, commercial, retail, industrial, and healthcare space. Investors interested in having exposure to the real estate market but looking for less capital intensive and more convenient options might consider REITs as a potential option. Investors might be tempted to invest in REITs for three main reasons. They are: Property management without headaches, diversification, and yield and potential tax benefits.

First, investors do not have direct ownership of the properties owned/ managed by the REITs, but they do benefit from the cash flows (mainly rent payments) originated from these properties. Hence, REITs’ investors do not have to spend their own time, energy, and resources dealing with all the aspects related to searching, acquiring, and occupying properties, they simply buy the security and collect the cash flows.

Second, REITs add diversification to investors’ portfolio. According to Morningstar, over the period from 1972 through Dec. 31, 2019, the correlation between the FTSE NAREIT Equity REITs index and the S&P 500 has averaged about 0.56. The correlation with fixed-income securities (as measured by the Bloomberg Barclays U.S. Aggregate Bond Index) has been even lower, averaging 0.24 over the period from December 1976 through Dec. 31, 2019.

Third, because of their legal structure, REITs don’t pay corporate taxes on their earnings. Instead, they are required to pay out at least 90% of their taxable income as dividends to shareholders, who eventually pay ordinary income taxes on the dividends they receive.

REITs Requirements

Companies willing to become a REIT must comply with the following requirements from the Securities and Exchange Commission (hereafter “SEC”):

· Have at least 100 shareholders after its first year of existence;

· Be an entity that would be taxable as a corporation but for its REIT status;

· Be managed by a board of directors or trustees;

· Have shares that are fully transferable;

· Have no more than 50 percent of its shares held by five or fewer individuals;

· Pay a minimum of 90 percent of taxable income in the form of shareholder dividends yearly;

· Invest at least 75 percent of total assets in real estate, cash, or U.S Treasuries;

· Derive at least 75 percent of its gross income from real estate related sources, including rents from real property and interest on mortgages financing real property; and

· Derive at least 95 percent of its gross income from such real estate sources and dividends or interest from any source; and

· Have no more than 25 percent of its assets consisted of non-qualifying securities or stock in taxable REIT subsidiaries.

As can be seen, REITs face several requirements in terms of their corporate governance and operations which allows them to deduct all of the dividends payout to their shareholders from their corporate taxable income. The tax advantage is certainly attractive, but REITs’ strict distribution and investment requirements might make them less flexible than any other equity security in moments of severe economic stress such as the one we are currently going through with COVID-19. Now that we have a better understanding of how REITs operate, let’s analyze how the current macroeconomic environment can cause major detriments on REITs valuations in the U.S, more specifically in the retail space.

The Surge of E-commerce

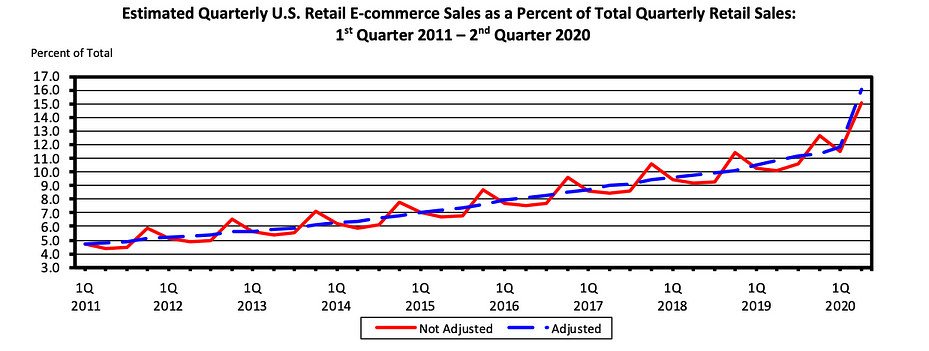

The COVID-19 novel has forced people to shift their shopping habits willingly or not. According to the Census Bureau of the Department of Commerce announced on August 18th 2020, e-commerce sales in the second quarter of 2020 accounted for 15.1 percent of total sales. The second quarter 2020 e-commerce estimate increased 31.8 percent (±1.2%) from the first quarter of 2020 and 44.5 percent (±1.9%) from the second quarter of 2019 while total retail sales decreased 3.6 percent (±0.5%) in the same period.

As can be seen from the graph, U.S Retail e-commerce sales which were already on an uptrend, have become an even larger threat for the brick-and-mortar retailers still standing. To stay competitive, some brick-and-mortar retailers are having to invest more heavily in their operations. For instance, they are having to improve their online shopping platforms and at the same time having to incur extra expenses associated with additional required safety measures in their respective physical stores to follow strict CDC Covid guidelines. These factors are turning physical stores less attractive and giving e-commerce a major leg up given the current macroeconomic environment. Interestingly enough, a report done by Credit Suisse back in 2017 estimated that 20 to 25 percent of malls would close down by 2022, largely because of store closures. According to a more recent report from Coresight Research, more than 8,000 retail locations have closed so far in 2020 and as many as 25,000 traditional bricks and mortar retailers could shut down permanently. Even though COVID-19 and its ramifications have certainly helped to accelerate traditional brick and mortar retailers’ store closures, the shift from brick and mortar to e-commerce shopping has started long ago.

Section 4013 of Cares Act a Temporarily Rescue

Not surprisingly, as the U.S economy was shutting down at the end of March 2020, the U.S Government had to act to take equity securities such as REITs off the hook. Under Section 4013 of the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, financial institutions such as REITs are allowed to basically suspend troubled restructuring accounting beginning March 1st and ending on the earlier of December 31, 2020, or 60 days after the national emergency terminates. If you would like more specific information look for the Financial Accounting Standard Board Accounting Standards Codification Subtopic 310–40, Receivables — Troubled Debt Restructurings by Creditors. In plain words, REITs have been granted authority to not use GAAP accounting by recognizing any rent revenue deemed affected by Covid-19 as rental receivable, despite the fact that the tenant might have stopped paying for the rent. This temporarily accounting “grant” might very well be masquerading the true financial strength of REITs especially the ones in the retail space since they were already being pressured by the shift from the brick and mortar to e-commerce shopping.

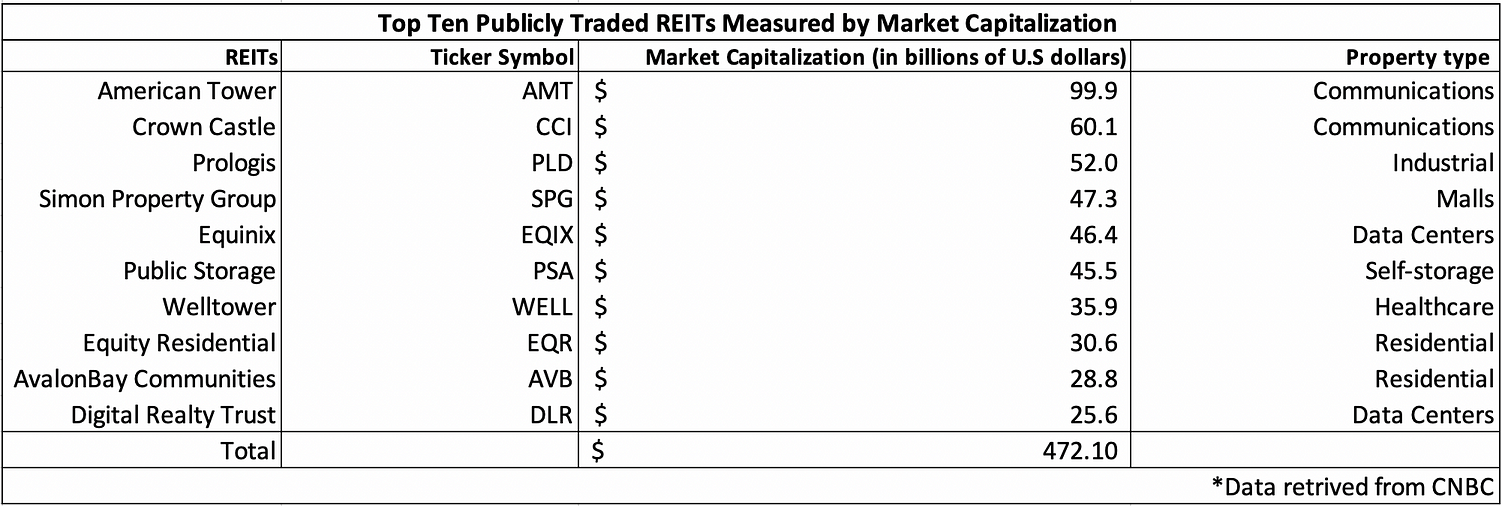

To analyze the impact as well as the extent to which REITs are relying on the 4013 Section of the CARES Act, data from the top ten publicly-traded REITs measured by their market capitalization was pooled. According to the National Association of Real Estate Investment Trusts, these ten REITs aggregated market capitalization value corresponds to about 41.23 percent of the entire REITs equity market value in the United States.

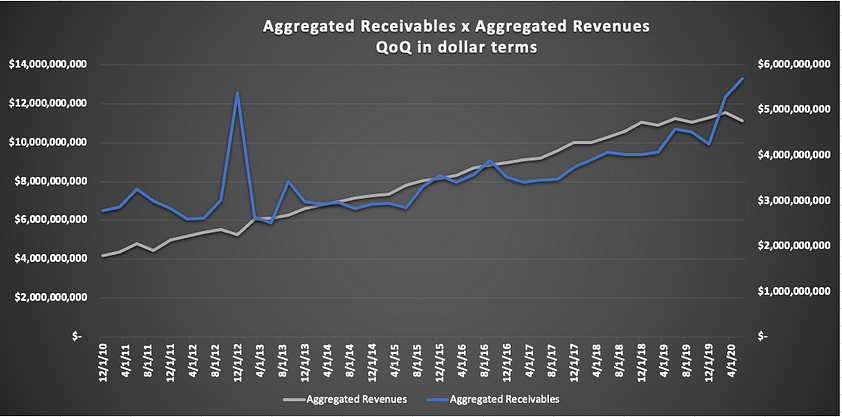

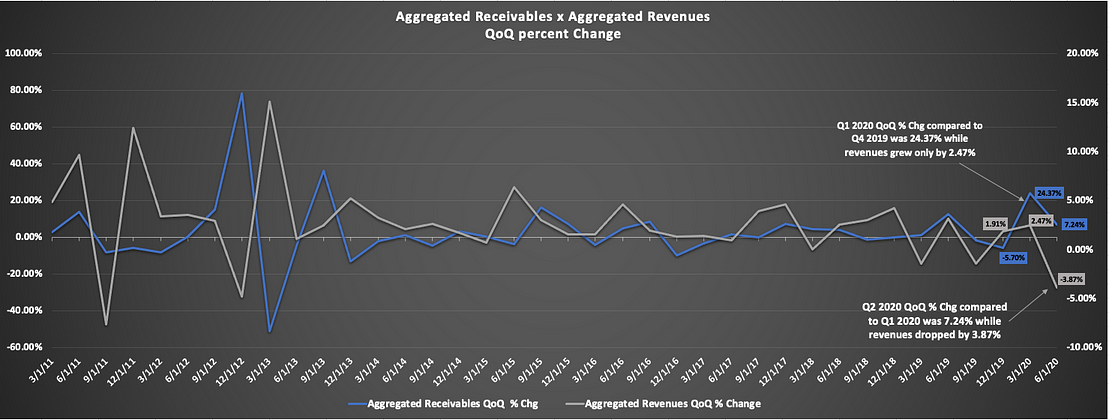

Furthermore, quarterly financial statement reports were collected from each one of the REITs listed above from 4Q 2010 until 2Q 2020, a total of 39 quarterly reports in a nine and half year period. As can be seen from the graph below, the aggregated receivables of the top ten publicly-traded REITs have increased by 24.37 percent from Q4 2019 to Q1 2020 while revenues for the same period grew only by 2.47 percent. By the same token, aggregated receivables in Q2 2020 increased by 31.61 percent if compared to Q4 2019 levels and 7.34 percent in comparison to Q1 2020 while aggregated revenues decreased by 3.87 percent from Q1 2020 levels and 6.34 percent from Q4 2019 levels. According to the presented data, there might be over 1.4 billion dollars in potential revenues facing a very high likelihood of not being collected due to default, but still being recognized in the books of the top ten publicly-traded REITs as receivables, following the 4013 Section of the CARES Act which allows the recognition of any rent revenue deemed affected by COVID-19 as rental receivable. As noted, both aggregated percentage change data strongly suggest that REITs’ financial strength is overstated.

Simon Property Group Valuation

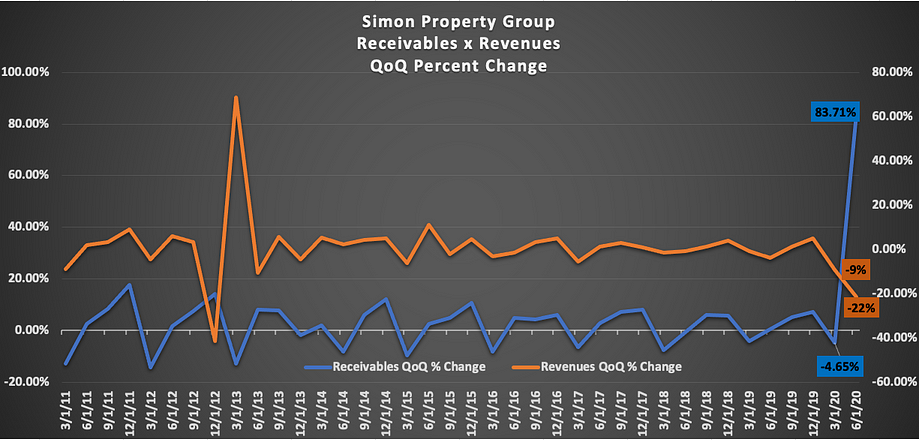

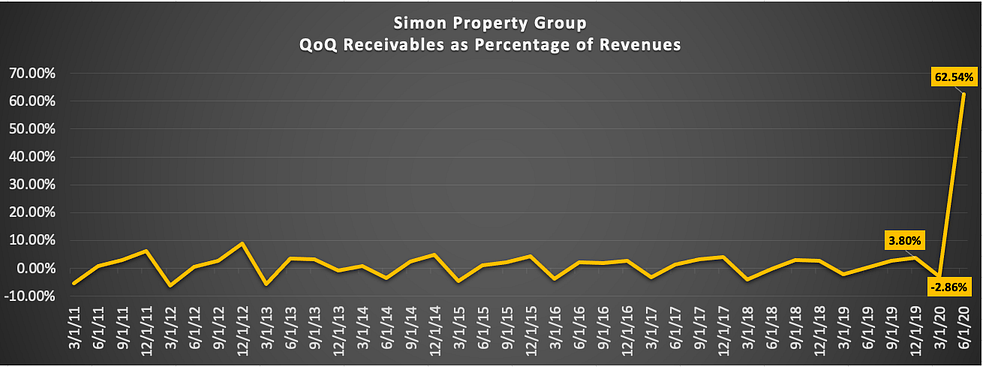

After performing further research to learn which one of the top ten publicly-traded REITs are most susceptible to overstate their books due to the 4013 Section of the CARES Act, a top pick was found, Simon Property Group (hereafter “SPG”). SPG owns, develops, and manages premier shopping, dining, entertainment, and mixed-use destinations. As of September 30, 2020, SPG holds an interest in 204 income-producing properties in the United States, which consists of 99 malls, 69 Premium Outlets, 14 Mills, four lifestyle centers, and 18 other retail properties in 37 states and Puerto Rico. SPG properties portfolio is heavily concentrated in the retail space which is one of the main sectors that have been negatively impacted by COVID-19 and the advent of e-commerce. A similar fundamental analysis performed to the top ten publicly-traded REITs as an aggregated was performed to SPG. The results are much direr. SPG receivables decreased by 4.65 percent from Q4 2019 to Q1 2020 period, but it shot up to 83.71 percent in Q2 an increase of 76.42 percent if compared to Q4 2019 levels. Revenues have decreased by about 9 percent from Q4 2019 to Q1 2020 period and about 31 percent if comparing Q2 2020 to Q4 2019 levels. SPG receivables as a percentage of revenues have also skyrocketed hitting an extreme mark of 62.54 percent in Q2 2020. This suggests that for every dollar of recognized revenue in Q2 2020, 62 cents was allocated into SPG’s receivables. Also, SPG receivables increased by 74.52 percent from Q4 2019 to Q3 2020, which further suggests that the company’s valuation should be assessed with extra care by investors.

The Impact of 4013 Section of the CARES Act in SPG Valuation

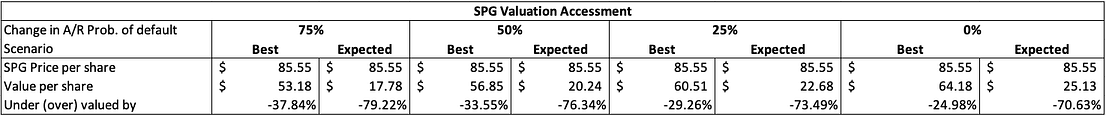

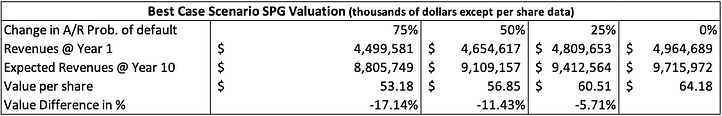

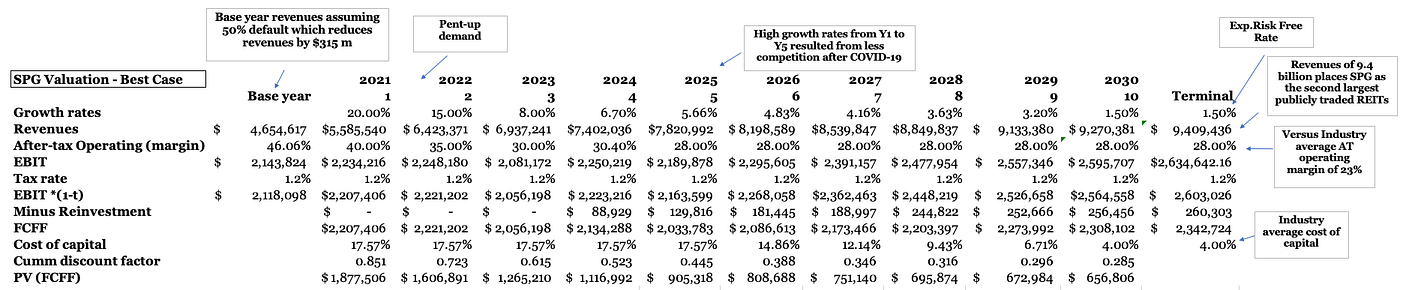

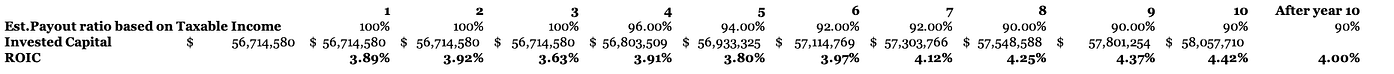

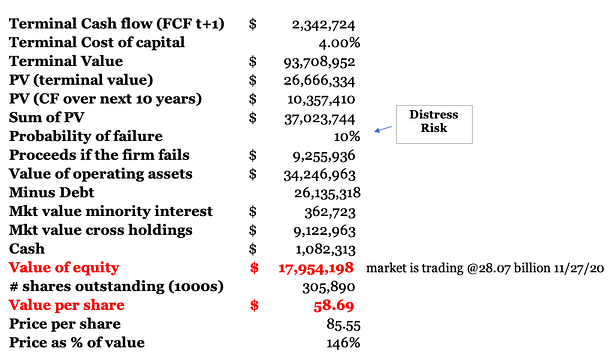

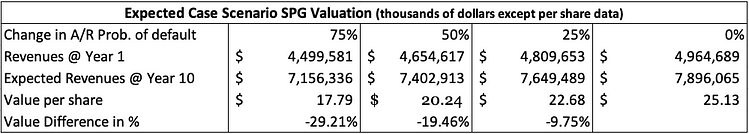

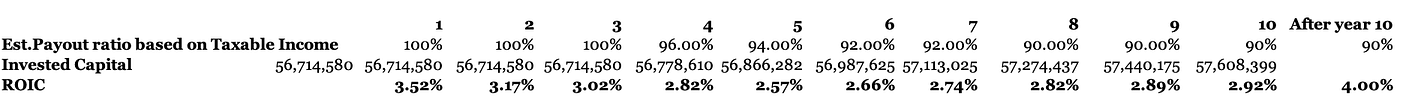

To further analyze the extent to which SPG valuation might be impacted by the privileged accounting treatment for financial institutions such as REITs under the CARES Act, two discounted cash flows valuation were performed. One best case and other expected case scenario valuations, each addressing four different probabilities of default for the 74.52 percent increase in SPG accounts receivables which is equivalent to $620.1 million or about 30 percent of SPG’s equity.

Under the best case scenario valuation— SPG’s value per share ranges from $53.18 to $64.18 a difference of 17.14 percent from the most optimistic (0 percent) to the least optimistic (75 percent) probability of default scenario.

Under the expected case scenario valuation — SPG’s value per share ranges from $25.13 to $17.79 a difference of 29.21 percent from the most optimistic (0 percent) to the least optimistic (75 percent) probability of default scenario.

So, what?

The privileged accounting treatment under Section 4013 of the CARES Act for financial institutions such as REITs is set to expire on December 31st, 2020, but there is also a possibility that it gets extended as the notorious economist Milton Friedman once said “nothing is so permanent than a temporary government program”. While SPG stock is looking grossly overvalued, even under the best set of assumptions, momentum seems to be the main driver at the moment moving SPG stock price higher. Investors willing to take the macro bet that in-store shopping will rebound strongly should also keep their eyes on the embracement of e-commerce and on the solvency of the companies heavily involved in the retail space as their fundamentals might be undergoing extreme stress. My advice for you is to size your bets and fasten your seatbelts because it is going to be a bumpy ride.