How to conquer behavioural biases in investing

Investing is not just about numbers, charts, and financial analysis, it is also a deep dive into the human mind.

The field of behavioural finance has taught us that our psychological biases play a significant role in our investment decisions.

In this article, we will look at some of the most common behavioural biases that affect investors and provide practical tips on how to recognise and overcome them to make more rational investment choices.

Confirmation Bias

One of the most prevalent biases in investing is confirmation bias.

This is the tendency to seek out information that confirms our existing beliefs or decisions while ignoring or downplaying information that contradicts them.

Imagine you are considering investing in a particular stock, and you are convinced yourself that it is a great opportunity.

You start researching and every positive news article or analyst report you find only reinforces your belief in the stock’s potential.

You might even ignore the warning signs because they do not align with your preconceived notion.

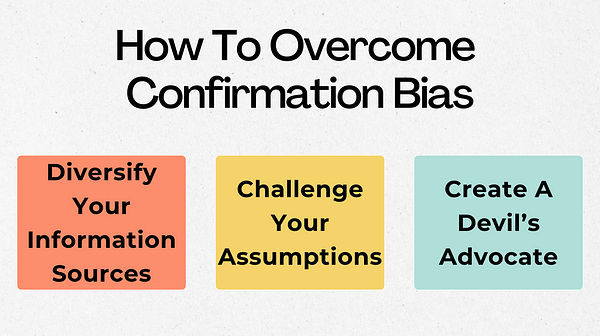

How To Overcome Confirmation Bias

- Diversify your information sources:

Make a conscious effort to seek out information from different sources, including those with opposing views.

This will help you gain a more balanced perspective. - Challenge your assumptions:

Continually question your beliefs and assumptions about an investment.

Do not just look for confirmation, actively seek out information that challenges your views. - Create a devil’s advocate:

Encourage someone to play the role of the devil’s advocate when discussing your investment decisions.

This can help you consider alternative viewpoints.

Loss Aversion

Loss aversion is the tendency to feel the pain of losses more strongly than the pleasure of gains.

This bias can lead investors to make overly conservative decisions, like holding onto losing investments for too long or selling winners too early.

Let’s say you bought a stock, and it is starting to decline in value.

Your natural instinct might be to hold onto it in the hope that it will bounce back.

However, this fear of locking in a loss can lead to even greater losses if the stock continues to decline.

How To Overcome Loss Aversion

- Set clear exit strategies:

Determine in advance at what point you will sell an investment if it is not performing as expected.

Having a predefined plan can help you avoid emotional decisions. - Focus on the long term:

Remember that investing is a marathon, not a sprint.

Short-term fluctuations are part of the game, so keep your eye on your long-term goals. - Learn from mistakes:

Do not be afraid to admit when you have made a poor investment choice.

Use it as an opportunity to learn and improve your decision-making process.

Herd Mentality

Herd mentality is the tendency to follow the crowd and make investment decisions based on what everyone else is doing.

This can lead to bubbles and market crashes, as investors rush in and out of investments en masse without conducting proper research.

Think about the dot-com bubble of the late ’90s when everyone seemed to be investing in tech stocks without fully understanding the companies they were buying.

When the bubble burst, many investors suffered significant losses.

How To Overcome Herd Mentality

- Do your homework:

Take the time to thoroughly research investments and understand the underlying fundamentals.

Do not simply follow the crowd blindly. - Maintain a contrarian mindset:

Consider going against the herd when it makes sense.

Sometimes the most profitable opportunities arise when you are doing something different from the masses. - Stay informed, not influenced:

Stay updated on market news and trends, but do not let them dictate your decisions.

Trust your research and analysis.

Overconfidence

Overconfidence bias occurs when investors overestimate their knowledge, abilities, and the accuracy of their predictions.

This can lead to excessive trading, taking on too much risk, and ultimately, poor investment performance.

Imagine you have had a few successful investments, and you start to believe you have a special knack for picking winners.

As a result, you may become overconfident and make riskier bets, which can backfire.

How To Overcome Overconfidence

- Keep a journal:

Document your investment decisions, including the reasons behind them.

This can help you track your successes and failures and identify patterns of overconfidence. - Seek feedback:

Share your investment ideas with trusted friends or mentors who can provide honest feedback and challenge your assumptions. - Stay humble:

Remember that even the most experienced investors make mistakes. Stay humble and open to learning from both successes and failures.

In conclusion, investing is not just a numbers game, it is a psychological one as well.

Understanding and overcoming behavioural biases like confirmation bias, loss aversion, herd mentality, and overconfidence can significantly improve your investment decisions.

By diversifying your information sources, setting clear exit strategies, resisting herd mentality, and staying humble, you can become a more rational and successful investor.

The next time you are faced with an investment decision, take a moment to reflect on your biases and make choices that align with your long-term financial goals.

Happy investing!

If you would like to know more about finance and investing, feel free to check out the following list:

As always, if you have any other questions or thoughts, please feel free to add them to the responses section.

If you would like to stay connected, check out my website or follow me on my socials Linkedin & Instagram.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.